FinTech Blockchain Market 2030 Key Drivers and Industry Insights

Unlocking the Future of the FinTech Blockchain Market:

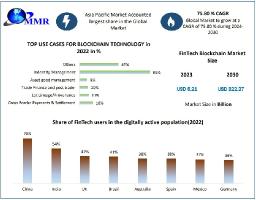

Maximize Market Research has published a comprehensive analysis of the FinTech Blockchain Market, revealing critical business insights and projections through 2030. This detailed report explores the current market dynamics, competitive landscape, and emerging opportunities across regions, giving you a front-row seat to the evolving FinTech Blockchain industry.

Forecasted Expansion of FinTech Blockchain Market:

Looking for insights? Request your free sample report now: https://www.maximizemarketresearch.com/request-sample/13770/

What's Inside the Report:

In-Depth Analysis & Segmentation

This report delves into every aspect of the FinTech Blockchain market, segmenting it by service category, company size, end-user sector, and geography. Using advanced methodologies like PORTER and PESTLE analyses, we examine drivers, challenges, and growth opportunities to provide you with an actionable view of the market landscape.

by Application

Payments, clearing, and settlement

Exchanges and remittance

Smart contracts

Identity management

Compliance management/Know Your Customer (KYC)

Others (cyber liability and content storage management)

Payments, clearing, and settlement; exchanges and remittance; smart contracts; identity management; compliance management/KYC; and others (cyber liability and content storage management) are the market's divisions based on application. The market was led in 2023 by the payments, clearing, and settlement sector, which is anticipated to continue to maintain the greatest share of the FinTech Blockchain market during the forecast period. The FinTech Blockchain market's Payments, Clearing, and Settlement section focuses on using blockchain technology to improve and expedite trade settlement, payment processing, and financial transaction procedures.

by Provider

Application and solution providers

Middleware providers

Infrastructure and protocols providers

by Organization Size

Small and Medium-Sized Enterprises (SMEs)

Large enterprises

The market is divided into two segments based on the size of the organization: small and medium-sized businesses (SMEs) and large businesses. Over the course of the forecast period, small and medium-sized businesses (SMEs) are anticipated to dominate the FinTech Blockchain Market. Small firms use fintech to outsource complexity and expertise since they lack the time, resources, and human capital to build their own specialized digital solutions. SMEs greatly benefit from APIs and other low-code, plug-and-play solutions in general because they allow them to quickly implement digital solutions without incurring any upfront costs or affecting their business operations.

by Industry Vertical

Banking

Non-banking financial services

Insurance

The market is divided into three segments based on Industry Vertical: banking, non-banking financial services, and insurance. The banking sector led the market in 2023 and is anticipated to continue to retain the biggest share of the FinTech Blockchain market during the forecast period. Digital payments and banking were developed to make financial transactions easier by using worldwide technical advancements. There are now more types of digital banking than electronic banking. Among other things, it covers the usage of electronic cards for payments, mobile banking, and internet banking. In a similar vein, the worldwide market for digital payments is anticipated to expand by USD 360 billion by 2030. Any transaction that enables a digital payment is included in the payments industry.

Global & Regional Insights

Gain insights into the FinTech Blockchain market across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. The report examines each region’s growth patterns, demand fluctuations, and the macroeconomic factors shaping market trajectories.

Set to uncover key insights? Download your report sample now: https://www.maximizemarketresearch.com/request-sample/13770/

Competitive Edge:

Discover strategies of the key players in the FinTech Blockchain market and explore how they are navigating trends, expanding their portfolios, and capitalizing on emerging applications. From global leaders to regional influencers, this report provides a complete competitive analysis.

1. Ripple Labs Inc. (San Francisco, California, USA)

2. Coinbase (San Francisco, California, USA)

3. Gemini Trust Company (New York, New York, USA)

4. Chain Inc. (San Francisco, California, USA)

5. Digital Asset Holdings (New York, New York, USA)

6. Circle Internet Financial (Boston, Massachusetts, USA)

7. Consensys (Brooklyn, New York, USA)

8. BitPay (Atlanta, Georgia, USA)

9. Corda (R3) (New York, New York, USA)

10. Kraken (San Francisco, California, USA)

Table of Content: FinTech Blockchain Market

Part 01: Executive Summary

Part 02: Scope of the FinTech Blockchain Market Report

Part 03: Global FinTech Blockchain Market Landscape

Part 04: Global FinTech Blockchain Market Sizing

Part 05: Global FinTech Blockchain Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Interested in market perspectives? Review the research report summary: https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

Key Highlights:

Historical Market Data (2018-2022)

Forecasts by Segment, Region, and Industry Application (2024-2030)

SWOT Analysis, Value Chain Insights, and Growth Drivers

Legal Aspects by Region and Emerging Opportunities

Top Questions Answered:

What are the key growth drivers and trends in the FinTech Blockchain market?

Who are the major players, and how do they maintain a competitive edge?

What new applications are poised to revolutionize the FinTech Blockchain industry?

How will the FinTech Blockchain market grow in the coming years, and at what rate?

Discover trending insights in Maximize Market Research’s newest publications:

Global Motor Driver ICs Market https://www.maximizemarketresearch.com/market-report/global-motor-driver-ics-market/86789/

Global Vibration Control System Market https://www.maximizemarketresearch.com/market-report/global-vibration-control-system-market/104086/

Why Choose Maximize Market Research?

Our team’s expertise spans industries like medical devices, technology, automobiles, chemicals, and more. By partnering with us, you get market-validated insights, strategic analysis, and impactful recommendations that set you on a path to growth.

Contact Us:

Pune, Maharashtra

sales@maximizemarketresearch.com

+91 96071 95908 / +91 9607365656