Market Expansion: Financial App Industry to Surge from USD 1.44 Billion in 2023 to USD 2.80 Billion by 2030

Market Overview

The Financial app market industry is projected to grow from USD 1.435392 in 2023 to USD 2.80 billion by 2030, exhibiting compound annual growth rate (CAGR) of 12.14% during the forecast period (2023 - 2030).

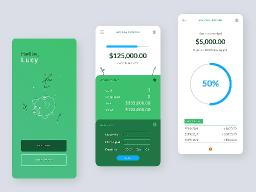

The financial app market encompasses mobile and web-based applications designed to assist individuals and businesses in managing their finances. These apps offer a range of services, including budgeting, investment management, digital payments, personal finance management, and financial planning. The market is growing rapidly due to the increasing adoption of smartphones, the rise in financial literacy, and the demand for convenient financial management solutions.

Get the FREE PDF Sample Copy (Including FULL TOC, Graphs, and Tables) of this report - https://www.marketresearchfuture.com/sample_request/5649

Key Market Segments

-

By Type

- Personal Finance Apps

- Investment Apps

- Banking Apps

- Payment Apps

- Loan Management Apps

- Budgeting Apps

- Cryptocurrency Apps

-

By Platform

- Android

- iOS

- Web-Based

-

By End-User

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises

-

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Market Trends

- Increased Adoption of Mobile Banking : Growing use of smartphones and mobile internet is driving the demand for mobile banking and financial management apps.

- Integration of AI and Machine Learning : AI and machine learning technologies are being integrated into financial apps for personalized recommendations, fraud detection, and automated financial management.

- Rise of Fintech Innovations : Innovations in financial technology are leading to the development of new and improved financial apps with enhanced features.

- Growing Popularity of Digital Payments : The shift towards digital payments and contactless transactions is boosting the adoption of payment apps.

- Focus on Data Security : Increased emphasis on data security and privacy features in financial apps to protect user information and transactions.

Key Companies

- PayPal Holdings, Inc. : A leading provider of digital payment solutions and financial management tools.

- Square, Inc. : Known for its payment processing solutions and financial management services for businesses.

- Robinhood Markets, Inc. : Offers investment and trading services through its mobile app.

- Intuit Inc. : Provides a range of financial apps including Mint, QuickBooks, and TurboTax.

- Revolut Ltd. : A global financial technology company offering digital banking and financial management services.

- Chime Financial, Inc. : Provides a mobile-first banking solution with a focus on no-fee banking services.

- N26 GmbH : A digital bank offering a range of financial services through its mobile app.

Market Dynamics

Market Drivers

- Growing Smartphone Penetration : Increased use of smartphones and mobile internet drives the adoption of financial apps.

- Consumer Demand for Convenience : Consumers seek convenient and accessible ways to manage their finances, boosting the popularity of financial apps.

- Technological Advancements : Innovations in technology, including AI and blockchain, enhance the capabilities and security of financial apps.

- Financial Literacy and Awareness : Rising financial literacy and awareness lead to higher adoption of personal finance and investment apps.

Market Challenges

- Data Security and Privacy Concerns : Ensuring the security and privacy of user data is a significant challenge for financial app providers.

- Regulatory Compliance : Compliance with financial regulations and standards can be complex and costly for app developers.

- Market Saturation : The market is becoming increasingly saturated with numerous financial apps, making it challenging for new entrants to gain traction.

Competitive Landscape

The financial app market is highly competitive, with numerous players offering a wide range of solutions. Key players compete based on technological innovation, user experience, and the breadth of their services. Companies are also investing in partnerships and collaborations to expand their market reach and enhance their offerings.

Regional Insights

North America

- Market Leader : North America leads the market due to high smartphone penetration, advanced technology infrastructure, and a strong focus on financial technology innovations.

- Key Drivers : Technological advancements, high consumer adoption rates, and a supportive regulatory environment.

Europe

- Growing Market : Europe shows significant growth with a focus on digital payments and financial technology innovations.

- Key Drivers : Regulatory support for fintech, increasing consumer demand for digital solutions, and a strong fintech ecosystem.

Asia-Pacific

- Rapid Growth : Asia-Pacific is experiencing rapid growth due to the increasing adoption of smartphones, rising financial literacy, and growing demand for financial management apps.

- Key Drivers : High smartphone penetration, expanding middle class, and investment in digital infrastructure.

Latin America

- Emerging Market : Latin America is an emerging market with growing interest in financial apps driven by increasing smartphone usage and financial inclusion initiatives.

- Key Drivers : Rising smartphone adoption, financial inclusion efforts, and investment in digital technologies.

Middle East & Africa

- Developing Market : The Middle East & Africa region is developing with increased investment in financial technology and digital infrastructure.

- Key Drivers : Economic diversification, growing digital adoption, and investment in fintech solutions.

Buy Research Report (111 Pages, Charts, Tables, Figures) - https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=5649

Frequently Asked Questions (FAQ)

-

What are financial apps?

- Financial apps are mobile or web-based applications designed to help users manage their finances, including budgeting, investing, digital payments, and financial planning.

-

What types of financial apps are available?

- Types include personal finance apps, investment apps, banking apps, payment apps, loan management apps, budgeting apps, and cryptocurrency apps.

-

Who are the key players in the financial app market?

- Key players include PayPal Holdings, Inc., Square, Inc., Robinhood Markets, Inc., Intuit Inc., Revolut Ltd., Chime Financial, Inc., and N26 GmbH.

About Us:

At Market Research Future (MRFR), we offer a range of market research solutions including Cooked Research Reports (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services. Our aim is to provide top-quality market intelligence to our clients, helping them navigate complex industries. We cover various market segments globally, regionally, and at the country level, empowering our clients to make informed decisions by offering insights into products, services, technologies, applications, end users, and market players. At MRFR, we strive to help our clients see more, know more, and do more, answering their most critical questions effectively.

Contact Us

Contact No.: +1 628 258 0071 (US), +44 2035 002 764 (UK)